iZettle is one of the better-known participants in very crowded European space, which includes rivals such as mPowa, SumUp, Cardease, Payleven and others.

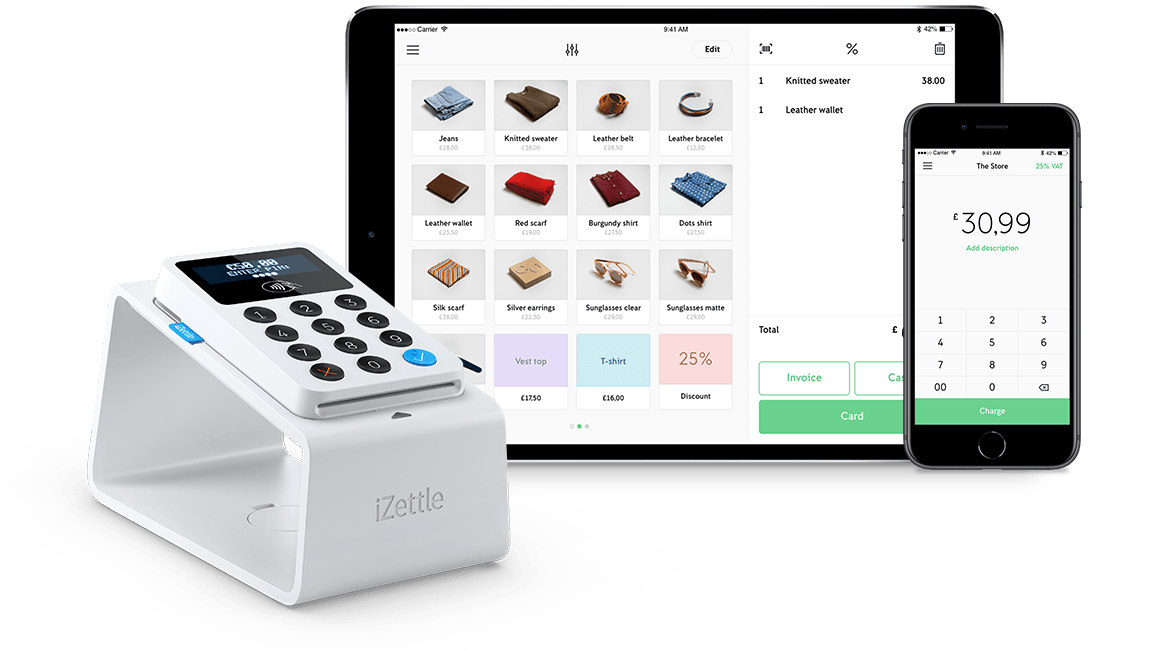

Its service lets merchants plug an accessory into their phone or tablet and then use this to accept credit or debit card payments, which are processed and logged via an app.

iZettle and its competitors are all jostling for footprint as fast as possible because the European Chip and PIN standard for credit and debit card payments is preventing the big US firms (Square, PayPal Here, Intuit etc) from exporting their EMV based services.

iZettle’s new funding includes American Express as an investor and adds additional capital on top of the previously announced funding total of €25 million.

The firm’s service is live in Nordic countries and has been in trials in the UK since the summer. However, press invites have gone out ahead of a full launch in November.

Observers will be interested to see if the launch includes support for Visa, which has yet to back the concept thanks to what it sees as a shortfall in tech standards.

AmEx loves it though.

“The payments landscape is changing rapidly and we believe iZettle’s solution will play an important role in helping to further enable commerce – especially in small merchant segments that have historically relied on cash – by delivering a smart and convenient way for small businesses to accept consumer payments,” said Werner Decker, SVP of merchant services Europe at American Express.